Introduction to trend trading

Trend trading is one of the most popular and time-tested strategies in the Forex market. At its core, trend trading is about identifying the direction in which a currency pair is moving—and then entering trades that align with that direction.

What is a trend?

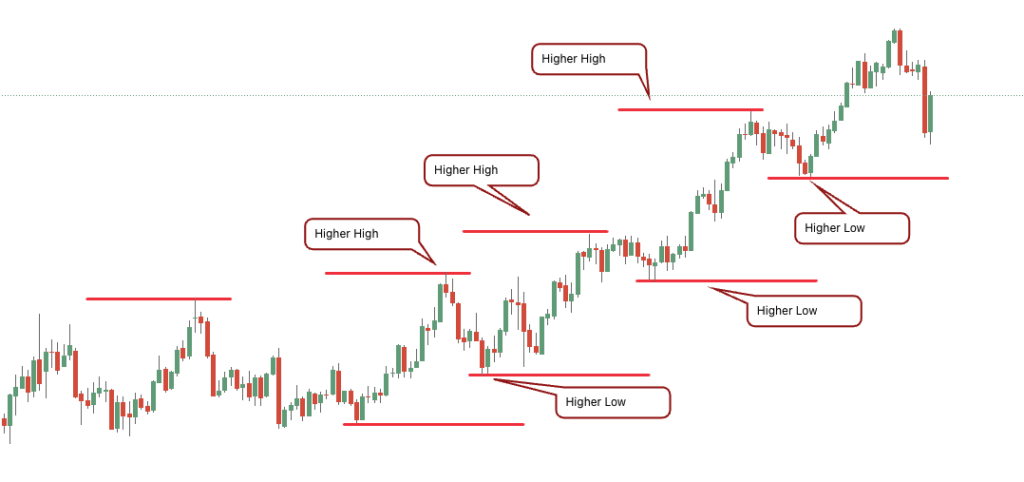

- Uptrend (Bullish): Price is making higher highs and higher lows

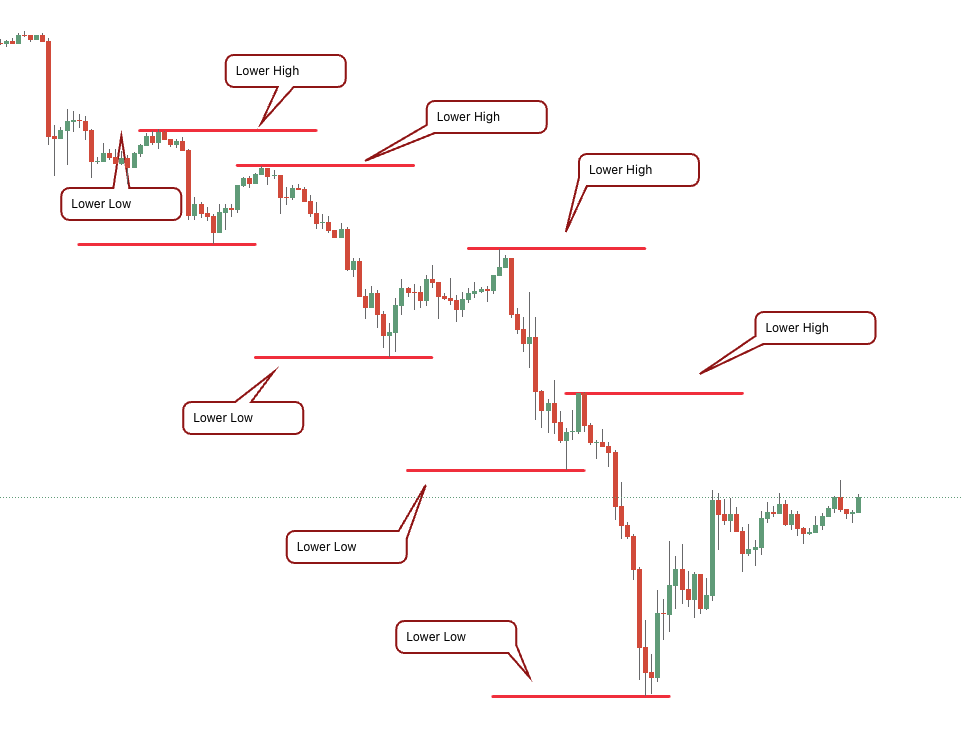

- Downtrend (Bearish): Price is making lower highs and lower lows

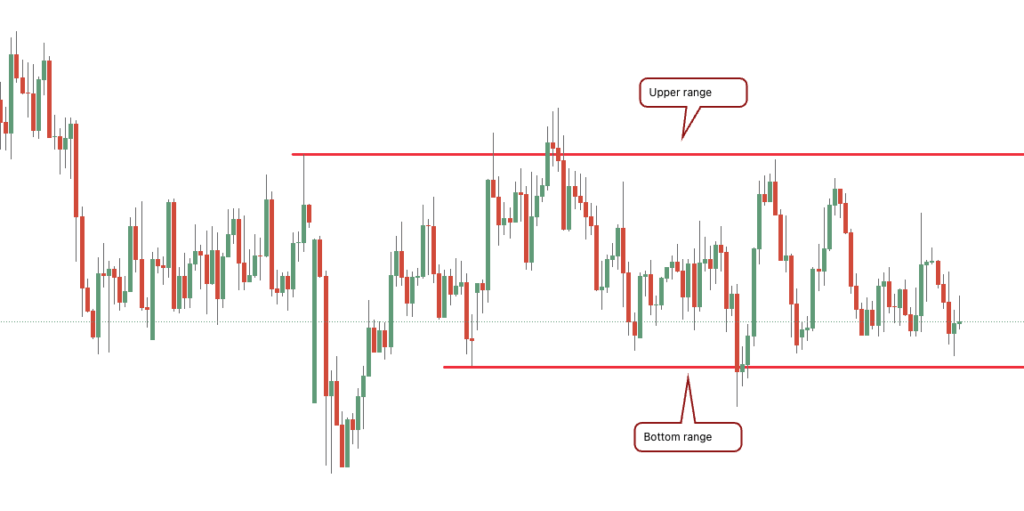

- Sideways (Ranging): Price moves within a horizontal range with no clear direction

Why do trends form?

- Economic data such as inflation numbers, interest rates, Non-farm Payrolls, retail sales etc

- Central bank policies (e.g., rate hikes)

- Market sentiment (fear/greed)

- Global news or geopolitical events

Why trade trends?

- You trade with the market, not against it

- Fewer trades, but higher probability setups

- Easier to manage risk with clear structure

- Trends are easier to read than choppy, directionless markets

When trend ends

- Reverse into a new trend

- Flatten into a range

- Fake out before continuing

- Price fails to make a new higher high (in an uptrend) or lower low (in a downtrend)

- Structure flips — e.g., lower low forms in an uptrend

- Price breaks below a key swing point or consolidates sideways for too long