XAUUSD

Since the sharp 17.8% rally to 3,500 between April 9 and 22, 2025, gold has pulled back, reaching a low of 3,120, supported by the 50 daily EMA.

The price action suggests the market is now in a consolidation phase. It is struggling to break above the resistance at 3,400, while the support at 3,250 remains intact.

As the price remains above the 50-day EMA on the daily chart, my bias remains tilted to the upside. However, caution is warranted until there are clearer signs of renewed demand.

EURUSD

EURUSD has been climbing on the back of broad USD weakness. After a strong 7.3% rally that took the pair up to 1.157 between April 3 and 21, 2025, it’s now pulling back—reaching as low as 1.107, where it found support at the 50-day EMA.

Over the past few weeks, however, the bullish momentum has clearly faded. Price action looks heavy near the top, and the pair is struggling to push higher. We will need to see if 1.137 support will hold. For now, it’s not an ideal time to hunt for long setups—patience is key until momentum shifts or a clearer structure forms.

USDJPY

After finding solid support at 140, USDJPY rallied and closed above the 50-day EMA on May 12, 2025. Over the following two weeks, although price action softened, it held above 142, forming a higher high and higher low—signs of a potential trend shift.

However, the next bullish push was rejected just below 146, with the 50 EMA acting as resistance. Price has since entered a brief consolidation phase and is now approaching the 50-day EMA once again, possibly forming a base.

If price manages to close decisively above the 50 EMA, I’ll be watching closely for a clean long setup. A confirmed break with follow-through could open the door for a fresh upside leg.

AUDUSD

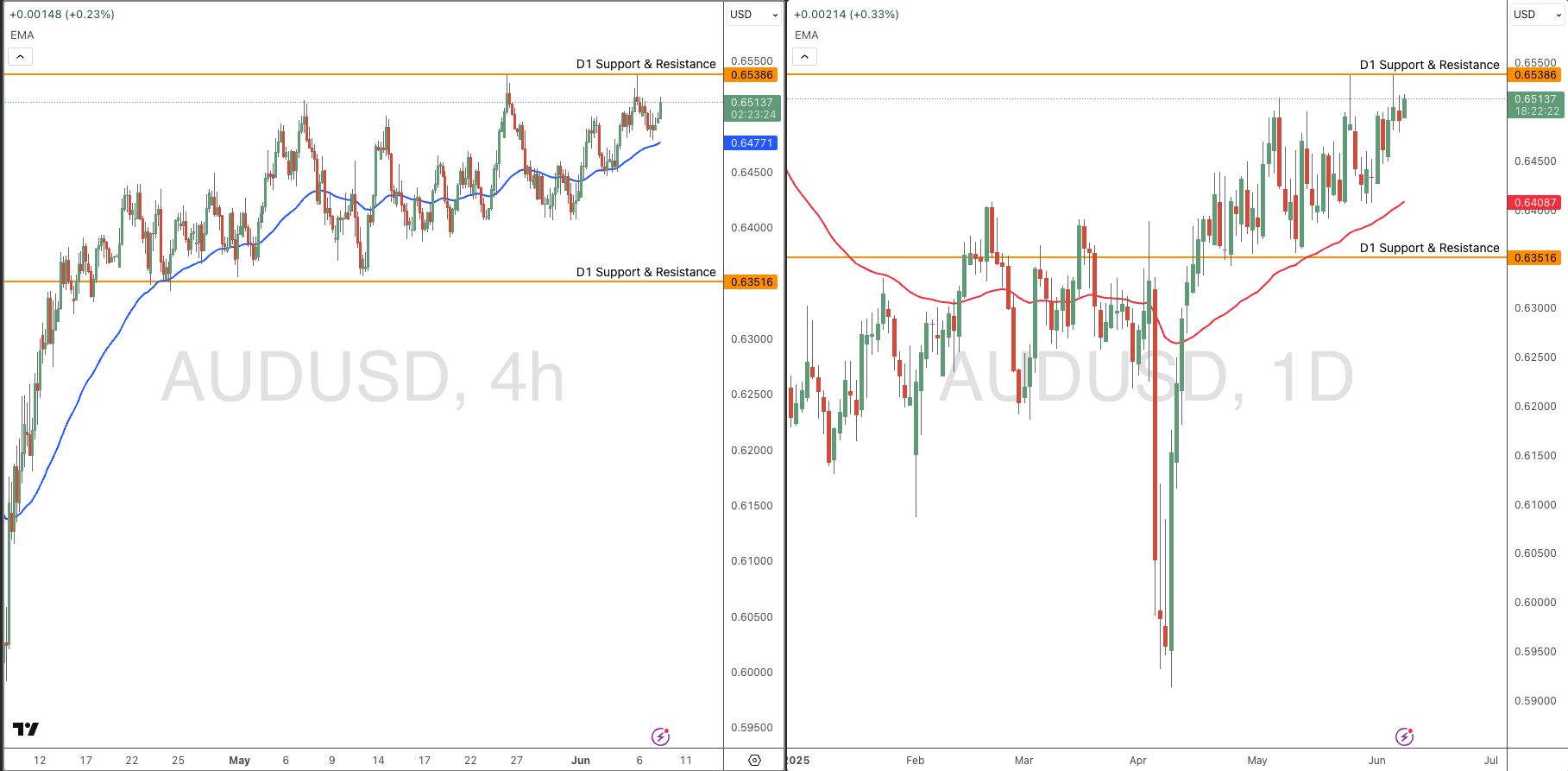

The AUD/USD is currently consolidating within a well-defined range between 0.6350 and 0.6540. This sideways movement reflects market uncertainty, largely driven by broader macroeconomic factors—particularly the ongoing trade friction between the U.S. and China, which heavily impacts Australia due to its strong trade ties with China and its status as a commodity-exporting economy.

As a result, price action remains indecisive, with neither bulls nor bears showing sustained control. For now, I don’t see a compelling setup. A decisive breakout above 0.6540 could open the door to a bullish continuation, while a breakdown below 0.6350 may signal renewed bearish momentum.

Until we see a clean break and confirmation on either side, I’m staying on the sidelines.