XAUUSD

Gold started this week by bouncing off the 3,300 level on Monday morning, after pulling back slightly at the end of last week. This level acted like a “floor” for the price, where buyers stepped in and pushed it back up.

On June 11, the U.S. inflation report (CPI) came in weaker than expected. This news made traders think the Federal Reserve might lower interest rates sooner, which is usually good for gold. After that, gold moved higher and closed strongly above the 50 H4 EMA, showing strength in the trend.

The move gained more momentum last Friday, when new tensions in the Middle East increased market uncertainty. In times like this, investors often turn to gold as a safe-haven asset. That helped gold break clearly above the 3,400 level, which was a key resistance area.

With these bullish signs—strong support at 3,300, positive reaction to news, and breaking above 3,400—gold looks ready to go higher. If you’re considering a long (buy) trade, it may be worth watching for a small pullback to around 3,380–3,400, which could now act as a “new floor” or support zone.

EURUSD

EURUSD made a strong move last week. After spending some time moving sideways (called “consolidation”), the pair finally broke above the key resistance level at 1.1450. This happened after U.S. inflation (CPI) data came in lower than expected, which made traders think the U.S. Federal Reserve might start cutting interest rates. Lower rates usually weaken the U.S. dollar—and that often helps EURUSD go higher.

After the breakout, the price climbed all the way to around 1.1620, creating a new higher high—a sign that buyers were in control.

But later in the week, news of conflict in the Middle East caused global markets to turn more cautious. In these situations, traders often move their money into the U.S. dollar because it’s seen as a safe haven. That caused EURUSD to drop back to the 1.1500 area.

Buyers came back in at this key support level, and the pair ended the week near 1.1550.

Right now, the area between 1.1500 and 1.1550 is an important support zone. If price stays above this area and starts to move up again, it could offer a good chance for a long (buy) setup.

But don’t rush in. Look for signs that buyers are still strong—such as:

– A bullish candlestick pattern (like a strong green candle or engulfing bar)

– A bounce off the 20 or 50 EMA

– A break above a small intraday resistance, like 1.1580

If the price falls below 1.1500 and stays there, then it’s best to wait. The next support is around 1.1450.

USDJPY

Last week, USDJPY tried to break above the important 145.00 resistance level, but it couldn’t hold above it. After that, the pair dropped sharply—this happened right after the U.S. CPI (inflation) report came in weaker than expected. That report made traders think the Fed might cut interest rates sooner, which weakened the U.S. dollar across the board.

So, USDJPY fell in line with the “weak USD” theme and moved down to around 142.50, forming a sharp reversal from the earlier highs.

However, later in the week, news of renewed conflict in the Middle East made global markets more cautious. In uncertain times like this, investors tend to buy the U.S. dollar because it’s considered a safe-haven currency. As a result, USDJPY found some support and began to bounce back.

Right now, the pair is trading in a range between 142.50 and 145.00—a 250-pip wide sideways move. This kind of price action might be a base-building phase, where the market is deciding its next direction.

Here’s what beginner traders should look out for:

– Support at 142.50 – If the price bounces here again, it shows buyers are still active.

– Resistance at 145.00 – If USDJPY can finally break and close above this level, it may start a new move higher.

– Geopolitical news and U.S. economic data – These can quickly shift sentiment, especially in a pair like USDJPY, which reacts strongly to risk appetite.

Until a clear breakout happens, this pair may continue to move within this range.

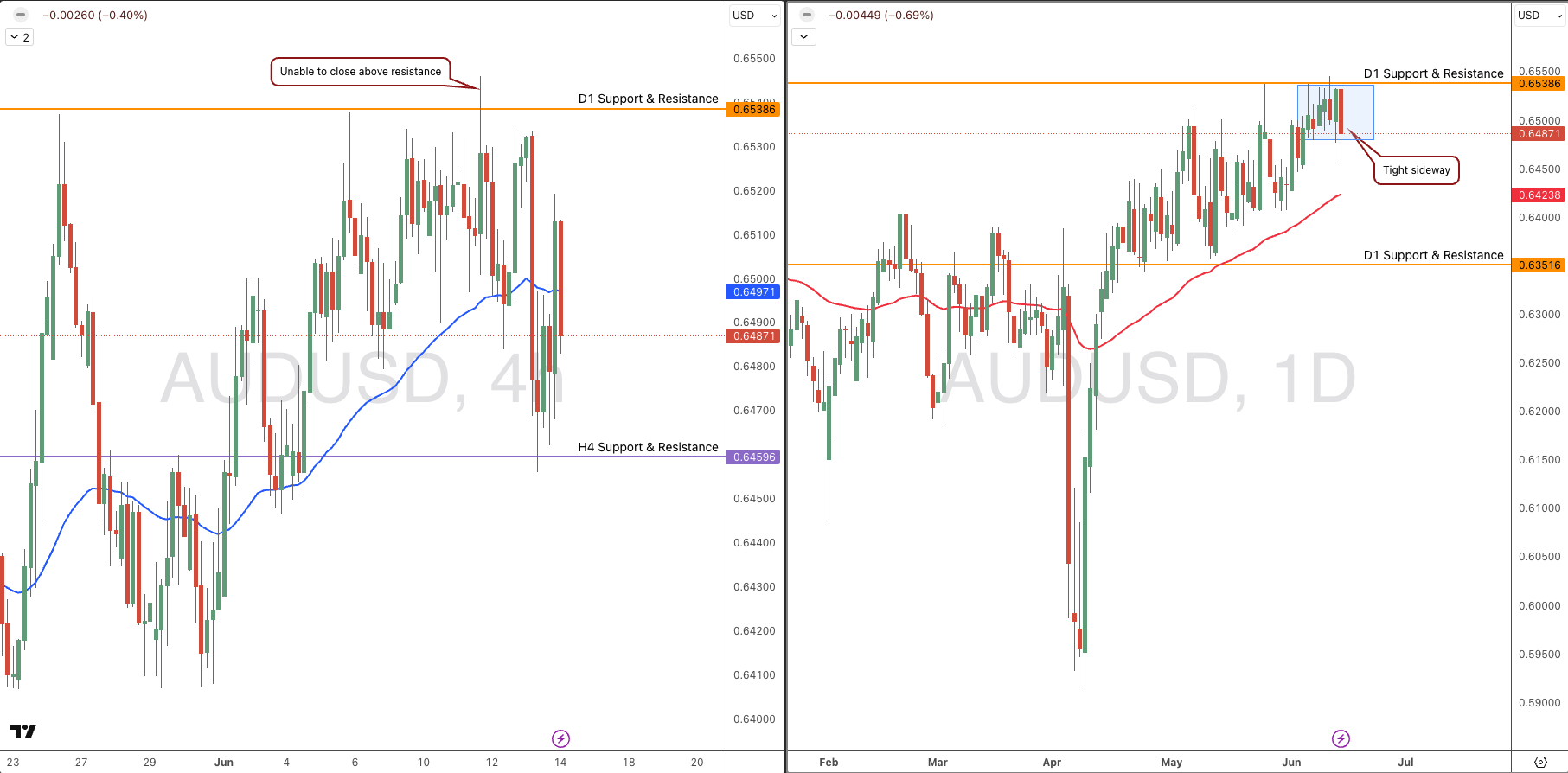

AUDUSD

AUDUSD had an interesting week, driven by U.S. inflation data and changing risk sentiment around the world.

The pair started the week moving higher as traders reacted to weaker-than-expected U.S. CPI data. This report increased hopes that the Federal Reserve might lower interest rates sooner than expected. A weaker U.S. dollar usually helps the AUD, so AUDUSD pushed up and tested near 0.6550, the nearest resistance level.

However, the rally lost momentum later in the week. News of renewed conflict in the Middle East made traders more cautious. In times of global uncertainty, the U.S. dollar often strengthens because it’s seen as a safe-haven currency. That shift caused AUDUSD to pull back toward the 0.6480–0.6500 area by week’s end.