XAUUSD

This week, Gold pulled back to the $3,350 level after rallying to a new high of $3,451. On the daily chart, a pin bar (a candlestick pattern that often signals rejection of lower prices) has formed at this $3,350 support level.

With the overall bullish structure still intact, traders might look for buying opportunities near this support level. However, because this uptrend has been going on for some time and looks a bit stretched, it’s also wise to be cautious — wait for confirmation that buyers are stepping in before going long.

EURUSD

After a strong rally last week, EURUSD pulled back to 1.145 before bouncing slightly. The pair looks like it may now enter a trading range for a while.

Traders might want to wait for a clear breakout of this range before committing to a new position. Until then, range strategies — buying near support and selling near resistance — could work well.

USDJPY

USDJPY finally broke out of its base, closing above the 50-day EMA — a signal of potential strength. The pair closed just below the nearby resistance level of 146.28.

There might be a short-term pullback before a further move higher toward 148. Patient traders could look for a retracement into support or the 50-EMA for potential long setups.

AUDUSD

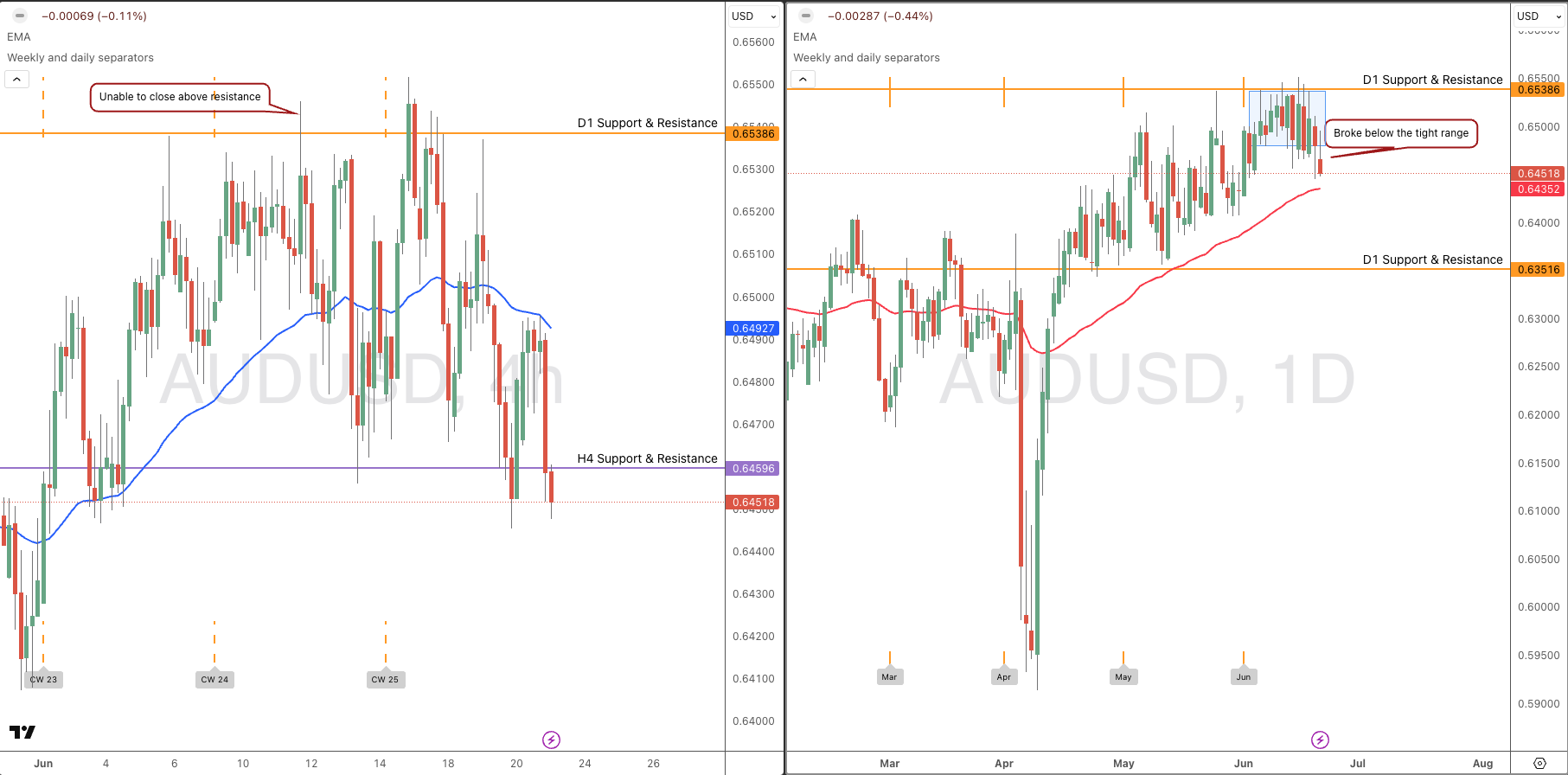

AUDUSD also broke out of its tight range and is now just below 0.645. The big question is whether 0.65 will hold as resistance.

If price fails to move above 0.65 and shows signs of rejection, that could mean a retest of lower levels around 0.64. However, a clear close above 0.65 could open the door for more upside momentum.