XAUUSD

Over the weekend, the U.S. launched a direct attack on Iran’s uranium facility for the first time. This kind of geopolitical tension usually drives gold prices higher due to “risk-off” sentiment.

However, that wasn’t the case. Instead, gold prices fell during the week and closed below the 50-day EMA for the first time in 2025 — a bearish signal for gold. That said, the market could still move sideways in the near term.

Support: $3,150

Resistance: $3,350

EURUSD

EUR/USD only ranged briefly before continuing its uptrend. The U.S. dollar weakened further following the end of the U.S. attack on Iran, helping the euro gain strength.

A series of higher highs and higher lows confirms the uptrend. There may still be some upside potential in the coming week.

Next resistance: 1.1900

USDJPY

USD/JPY’s strength didn’t last long. The pair briefly touched 148 before reversing sharply as the U.S. dollar weakened.

On the daily chart, the pair is now consolidating between 142 and 148. It’s best to wait for a clear breakout before considering any trades.

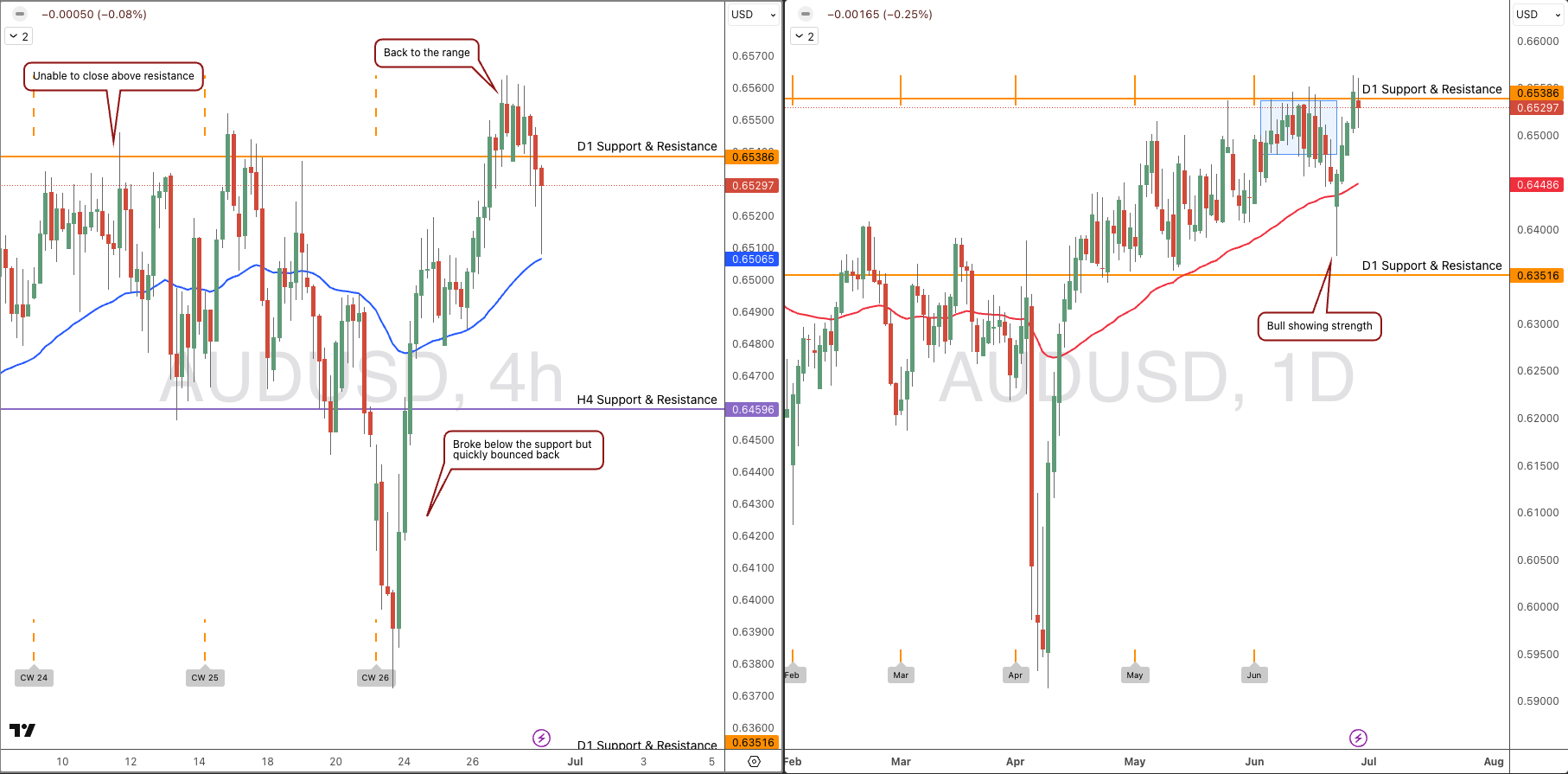

AUDUSD

Buyers were active early in the week, pushing AUD/USD to the top of its previous range.

With the U.S. dollar continuing to weaken and U.S. stock markets (S&P 500) hitting all-time highs, risk sentiment is improving. This “risk-on” environment could help AUD/USD break above 0.6550.