XAGUSD

After touching the high of 39.5, the silver has moved downward and managed to break the daily bullish price channel support.

This bearish momentum can be seen with the high volume break of the 200 H4 EMA and the 2 sell zones.

The silver price then bounced off the green support zone area (36.15 – 36.3) and currently being held at the sell zone (37.05 to 37.2), as well as the 20 & 200 H4 EMA. If this sell zone manage to hold, the silver may resume the down move with the first target at the green support zone and then the second target at the H4 horizontal support area (around 35.5).

EURUSD

EURUSD broke below the daily bullish price channel and pull back forming lower high and it then moved lower rapidly.

However, with its strong bearish momentum, the EURUSD was unable to break the green-coloured daily support zone between 1.1418 and 1.1450.

The price action showed a shake out and pushed the price back up on the weak NFP data release on August 1.

Price has since rallied back to the sell zone between 1.156 and 1.159. The 50 and 200 EMA also form the dynamic resistance at this area. If this sell zone manage to hold, the bearish momentum may resume.

USDJPY

The USDJPY was unable to push through the daily resistance around 151. The buyers gave up ground quickly with the release of the weak NFP.

The price has since moved back to the lower bullish price channel, which is the support zone made up of the horizontal support, 200 H4 EMA and the lower price channel.

We shall watch the price action closely between the buy & sell zones, for clues of the price movement next week.

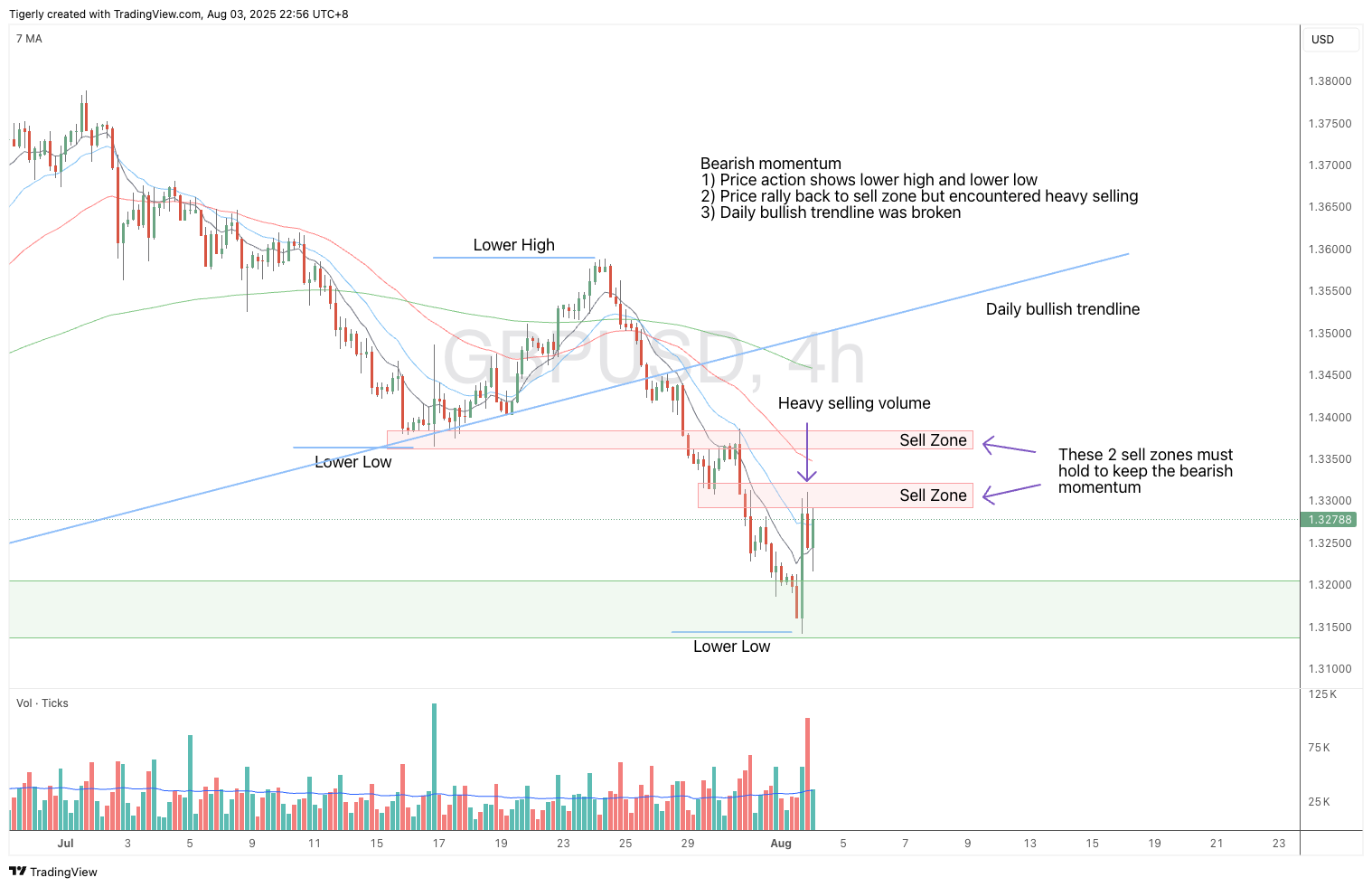

GBPUSD

This pair is showing similar price action as the EURUSD. The bearish move broke the daily bullish trend line and the horizontal support, forming lower high and lower low.

The green support zone (1.315 to 1.32) provided very strong support, pushing the price back to the sell zone. The 2 sell zones must hold for the bearish momentum to resume.

AUDJPY

After pushing through the 2 support zones (which now flipped to be sell zones), the daily bullish price channel and the 200 H4 EMA, buying appears around the H4 support area around 95.4.

As the price action exhibits lower high and lower low, AUDJPY is very bearish at the moment. We expect the price to pull back to the 2 sell zones.

However, for the bearish momentum to sustain, these 2 sell zones must hold. If so, the first target will be around 94.

GBPJPY

Just like AUDJPY, GBPJPY is displaying the same bearishness.

The bearish move broke the support of 200 H4 EMA, previous horizontal support and the daily bullish price channel with good volume.

We expect the price to bounce back up from the buy zone to one of the sell zones. If these sell zones manage to hold, the bearish move is expected to continue to at least 194.3.

EURCAD

EURCAD broke the triangular flag and jumped more than 100 pips in 3 H4 candles. The combination of horizontal support around 1.5776 and the daily bullish trend line provided the strong buying power.

As the move punched through the resistant zone (which now flipped to be a support or buy zone), we can expect the market to come back and retest it before moving higher. The buy zone is critical to the bullish move and it must hold. If so, the profit target is expected to be around 1.61, which is the previous high.