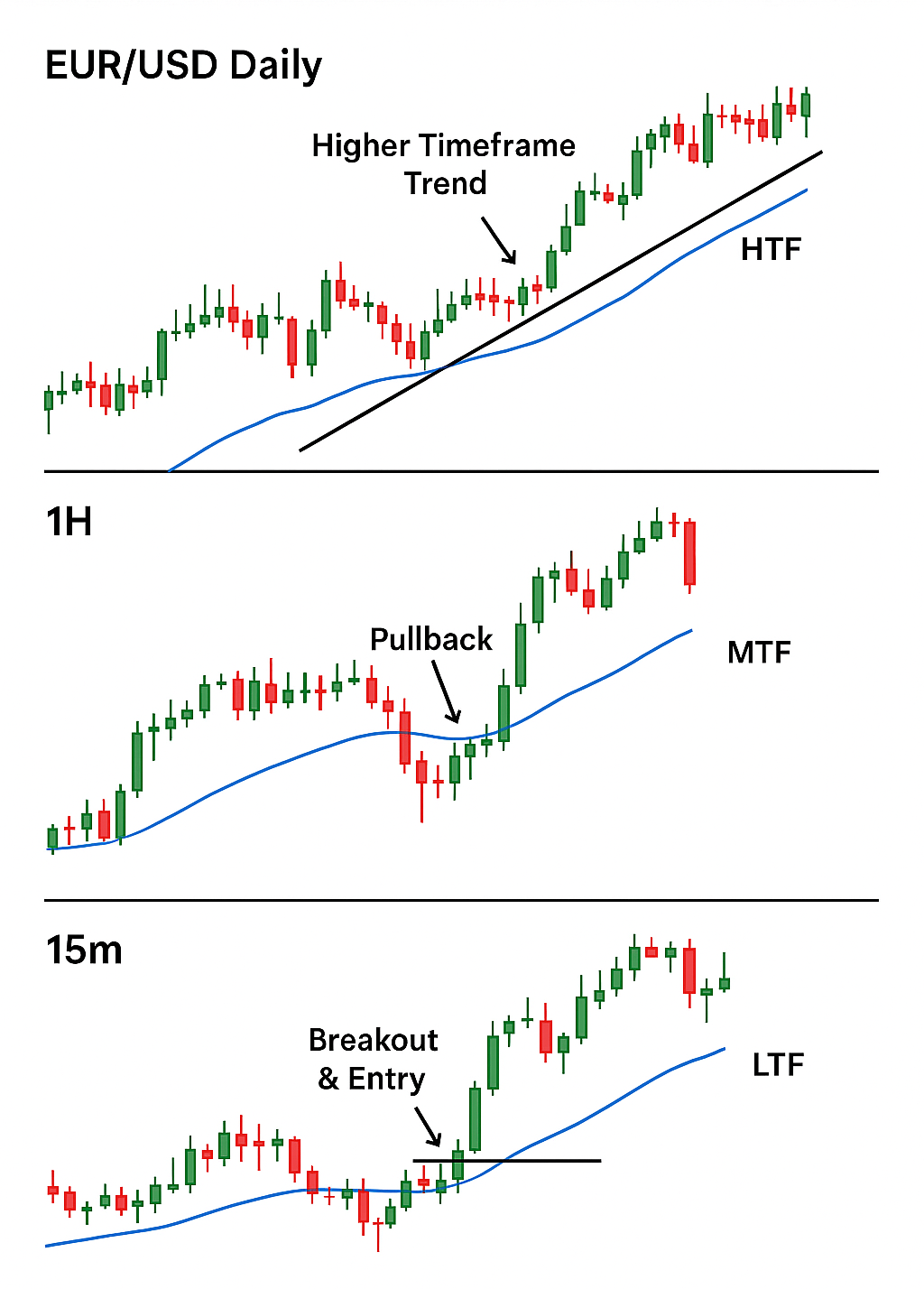

Multi-timeframe trend analysis

🧠 Key idea: Use higher timeframes to define the trend, and lower timeframes to fine-tune your entries.

| Level | Purpose | Example TF |

|---|---|---|

| HTF (Higher Timeframe) | Identify the dominant market direction | Daily, 4H |

| MTF (Middle Timeframe) | Spot setups & structure | 4H, 1H |

| LTF (Lower Timeframe) | Time precise entries | 1H, 15min, 5min |

- Higher highs & higher lows (uptrend)

- Lower highs & lower lows (downtrend)

- Consolidation zones or range boundaries

- Trendlines and 50/200 EMA orientation

- Pullbacks to a key moving average (20, 50 EMA)

- Bullish or bearish engulfing candles at trend continuation zones

- Consolidation near support/resistance ready to break

🎯 Example: On the 1H chart, price pulls back to the 50 EMA and forms a bullish engulfing candle in an uptrend.

- Minimize risk with tighter stops

- Avoid entering too early

- Get better R:R potential

- Breakout above a micro-resistance

- Bullish price action patterns

- MACD crossover or RSI bounce in trend direction